Don’t expect it to last forever.

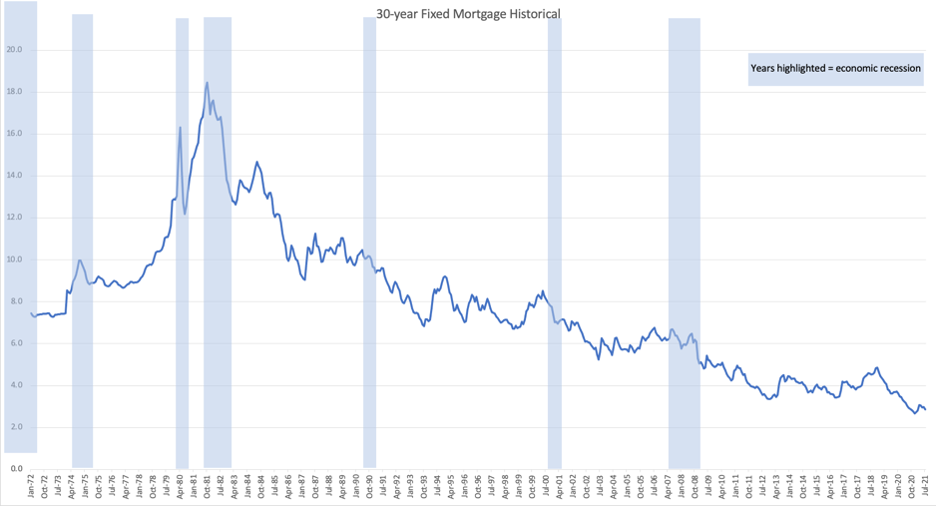

Current mortgage interest rates remain below 3%, however as the economy and employment numbers continue to show strength, and financial regulators begin to address underlying inflation concerns, an increase in rates is expected. According to their recent quarterly forecast, Freddie Mac projects the 30-year rate will end the year around 3.4%, rising to 3.8% by the fourth quarter of 2022. (Source)

What does this mean for homebuyers?

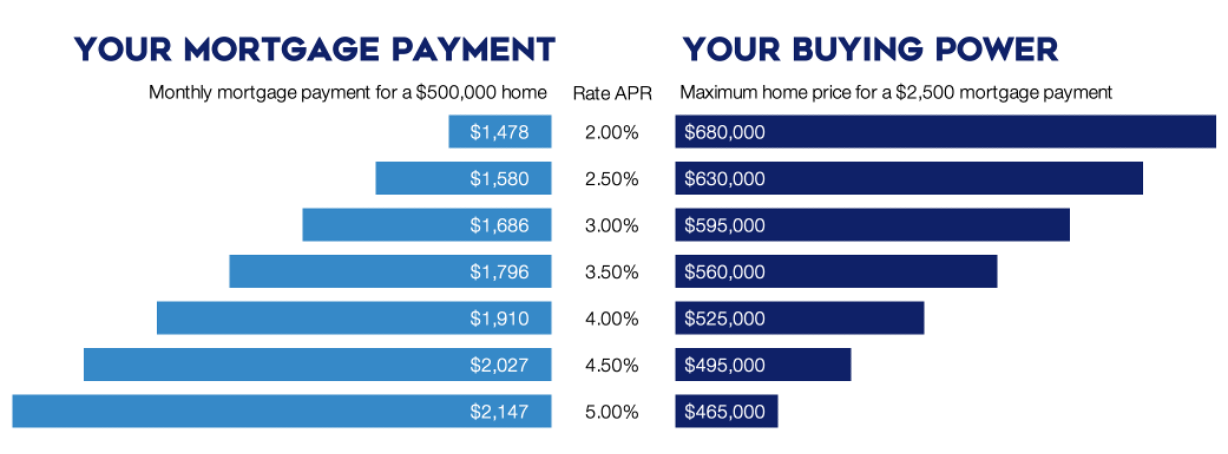

As interest rates increase, so too do monthly mortgage payments, while overall buying power decreases.

For example, if you purchased a home for $500,000 with a 3.0% APR (20% down payment) your monthly mortgage payment would be $1,686. Should that interest rate increase to 3.5%, your monthly payment would be $1,796, a 6.5% increase!

Similarly, if you had a monthly mortgage payment budget of $2,500 per month, at 3% APR you would be able to afford a home valued at $595,000. Should that interest rate also increase by half a point, you would only be able to afford a $560,000 home, a decrease of nearly 6% in buying power.

In a market like Hawaii – where home prices are naturally always high due to limited supply and what feels like unlimited demand – a rise in interest rates can directly impact one’s ability to purchase a home.

The good news

Once upon a time, from October 1978 – October 1990, interest rates were 10 while only 3 years ago they were above 4.5%. So even if interest rates were to increase, lending rates are much more favorable today than they once were.

It is also important to highlight that no longer do you need to put 20% down. Depending on the property and what you qualify for, some conventional loans offer 3% or 5% down, while VA and USDA loans offer no down payment options. In addition, there are several local and federal programs that offer incentives to first-time homebuyers.

The takeaway

Not all mortgages are the same, as there are different terms and lengths that can be tailored to fit your financial profile. To better understand what you qualify for, speak with a licensed mortgage lender who can help determine a home purchase budget and monthly payment that is comfortable for you.